In my last column I covered the potential sale of Emerald Expositions and the $2bn price tag that owners Onex had out on the business. At the time I commented that either a sale to another private equity firm or a stock market flotation (IPO) were the most likely outcomes.

It seems that, with $323.7m of revenue, $22.2m of net income and $63.6 million of adjusted net income, none of the potential buyers were willing to meet the valuation. So in a change of approach, Emerald filed with the US Securities and Exchange Commission and made it’s debut on the New York stock exchange at the end of April raising $264m.

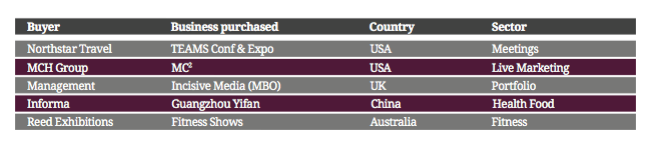

Emerald was formed in June 2013 when Onex bought Nielsen Expositions for $950m and renamed it Emerald Expositions. Since then, Emerald made a lot of acquisitions including George Little Management for $335m, National Pavement Expo, American Craft Retailers Expo and RFID Journal LIVE!

I have also been drawing comparisons between Emerald Expositions and Clarion Events, in particular their frenetic acquisition activity and I speculated that following the Emerald IPO we should expect a sale process for Clarion to follow. Well, we didn’t have to wait very long to hear that Providence Equity who acquired Clarion in January 2015 have appointed HSBC as sale advisors. Since Clarion effected an MBO from Earls Court and Olympia, they have been owned by a succession of private equity firms and the most likely scenario is another private equity buyer rather than a sale to an exhibition organiser.

In other corporate finance news, B2B Information company, Incisive Media has been acquired by its founder and Chairman Tim Weller, chief financial officer Jamie Campbell-Harris, and chief executive Jonathon Whiteley. Incisive is best known for its ownership of Investment Week and Professionals Pensions but it also holds a number of conferences and awards across the three main divisions – Enterprise Technology, Pensions and Benefits and Investment Wealth. Incisive was founded by Weller in 1994 and was subsequently listed on the UK stock exchange. After a number of restructures they have been majority owned most recently by private equity firm Alchemy Partners.

On to venues and the sale of Olympia Exhibition Centre to a consortium German institutional investors and Yoo Capital for £296m. Yoo Capital area hybrid private equity/property investment company. When rumours of a sale surfaced it was widely feared that Olympia would go the same way as Earls Court but concerns seem to have calmed down, at least for now.

On the technology side of the business, GES have followed up their acquisition of 2014 acquisition of N200 with another buy for their event intelligence division. Poken uses smart badges for digital document collection, visitor-to-visitor engagement and full metrics reporting. The two companies have had a strategic partnership for some time and the acquisition of Poken was a logic step.