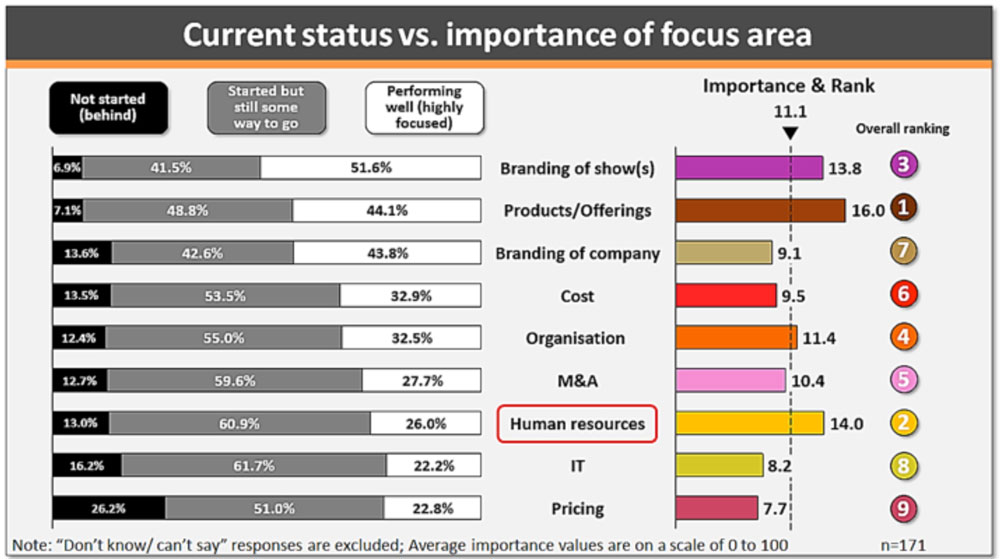

Recently JWC conducted a study investigating the factors that are important for event organisers, venues and the exhibition industry as a whole when it comes to sustaining or improving competitive positions. Some results were not at all surprising; figures clearly confirmed that when it comes to staging events – a people centric service – our employees, the effort to attract good talent, and of course the focus to retain the very best, rank high on the priority list (see figure 1).

However, it was startling to see a sharp drop between how important this focus area is and how much additional effort is deemed as necessary in this space. In other areas of high importance such as organisation, products and offerings, companies are not performing at competitive levels. With very few exceptions, this pattern was pervasive across the all functions and roles (organisational levels).

Well, you might think that’s a bit obvious. Do we really need all this data to tell us that water can be very wet? The short answer is yes. It’s about credibility. Before we start excavating more subtle or elusive insights, one important thing I always like to point out in our predictive analytics workshops is this: it is critical to have key elements of the data you are working with tell you something treally quite straightforward and obvious, things that quickly validate the day-to-day view of the business you know so well. For me, it is essential to see a pattern in the data, preferably even two or three, that I would expect to find there before I would be ready to trust it.

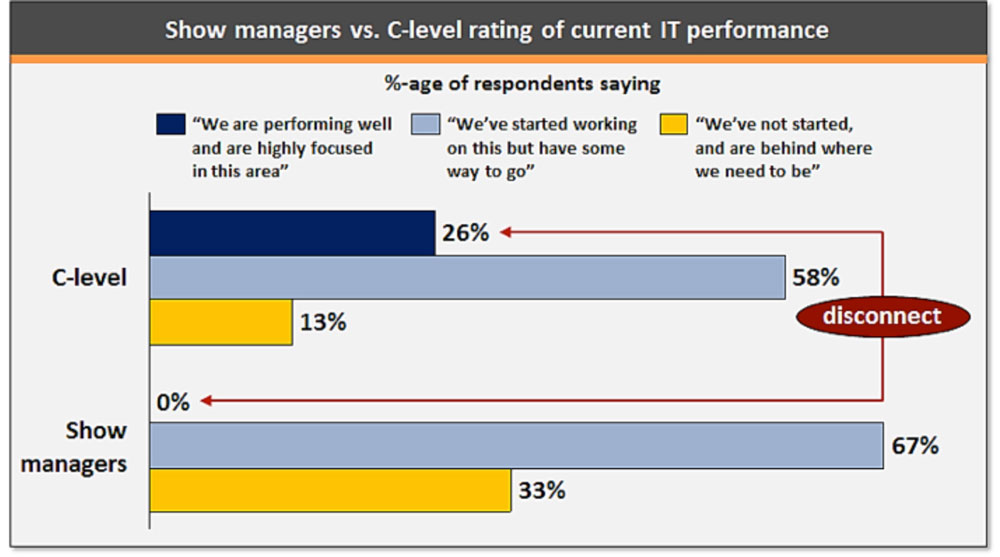

Moving on to some points that may be better hidden. Many times by combining a view of multiple (seemingly unrelated) data points, something well worth considering could be uncovered. Take for example the bipolar views held about IT. For the purposes of our study, we clearly delineated between IT and digital. IT was defined as everything to do with systems delivering individuals in the organisation the information they need at the right time. Our survey shows that overall IT is a focus area (when compared to others) characterised by the need to do a lot more.

Surveys broader than those just covering the exhibitions industry confirm that this is not an exhibitions industry anomaly. A recent study conducted by Computer Weekly in the UK (taking a view of both the private and public sectors) found that more than half (54%) of IT projects failed to deliver on the scope (promised benefits) that were expected at the onset. When ‘on-time’ and ‘budget’ are thrown into the mix, just 16 per cent of the 421 IT projects examined in the survey succeed. That’s an 84 per cent failure rate. So everyone seems to be struggling with IT.

But in our industry, and more specifically in companies in the business of organising shows, there are different views of how well things are going with IT, depending on where you sit in the organisation. In no other focus area were the differences between the various roles so glaring as in IT. Twenty-six per cent of the C-level respondents believe that their company is performing well in IT, while no show managers said their company is doing well and highly focused in this area (figure 3). It appears in some companies top management is unaware of the perceptions at the show management level when it comes to having good-quality information available. The situation of each company is surely different with its unique complexities. It is probably a relief to learn that everyone (direct competitors as well as the competition beyond face-to-face media) is frustrated by lack of progress in IT. It certainly doesn’t help that top management is likely unaware of the problem’s magnitude for those at the front line.

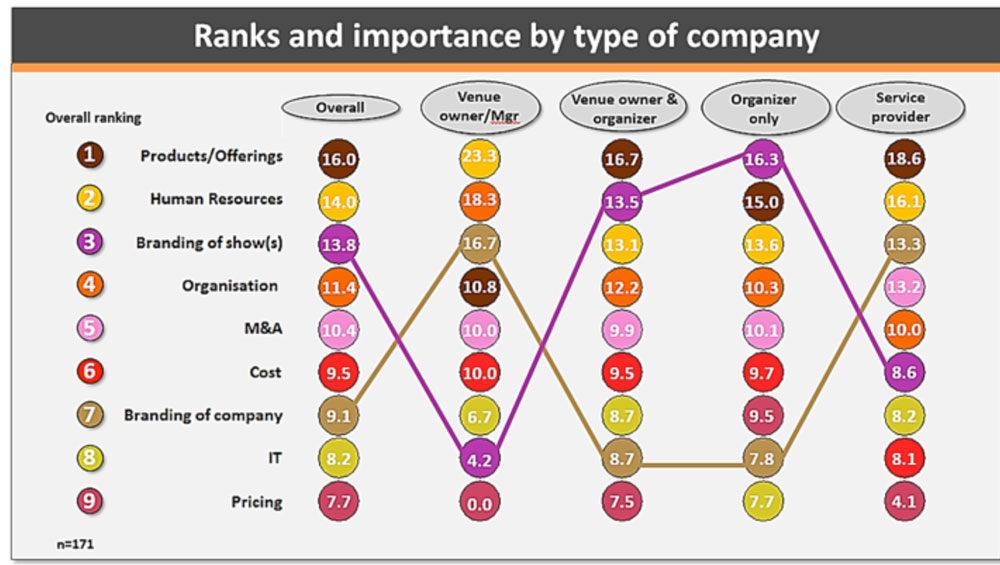

Finally, let’s try to illuminate a point that matters a great deal to the future of the exhibitions industry. Another story Figure 2 tells us is this: show brands are highly important (top ranked) for event organisers. For venue owners, the branding of their company (ie the venue) is important too, but ranks lower. Digging deeper, there is something else here with significant implications for our industry and the competitive threats with which we will have to come to terms in the future. Note that at 4.2 points, the brand of a show is really ‘not very important at all’ to the venues. In our work with organisers and venues we see the symptoms that this misalignment causes quite often.

The brand of a show is not just in its name. Many leading events around the world are unthinkable away from their host city and venue. Their success is not just closely tied, it is chained to the venue it is staged in. This is not just Airshow in Le Bourget, the Frankfurt Auto Show or the Nuremberg Toy Fair. There are many less prominent (but sector defining) events that have been hosted by the same venue for 20 or 30 years and more. Even more importantly, customers and particularly visitors frequently don’t differentiate between the venue owner/manager and the show organiser: For paying and hosted attendees the show and the venue bring a single, integrated value proposition. In the day-to-day supplier/customer relationships (venue/organiser) this critical point may sometimes fall by the wayside. Services rendered by the venue, the organiser and other third parties are not separate in the perception of our industry’s customers.

The brand of a show is not just in its name

Such event partnerships need to take a well-coordinated and balanced view of where their joint brand (even though this may not be reflected in the ownership structures) is evolving. In cases where this view is not taking hold, the show’s future becomes vulnerable. This is not just about growth in hall or outside space capacity and making sure a wall-bound problem is avoided. It is much more about a venue that may not be keeping up with the premium or cost-saving image that the show it hosts is working to project. Premium venue offerings, the feel of walkways, foyers, atriums, the service levels and choice of catering services, safety and security, cleanliness of the show, of the sanitation facilities and so on all need to be aligned if these partnerships do not want to put themselves in a weak position against the competition.

No-one can deny that in past decades exhibitions have brought a lot of value to organisers and the venues that stage them. One of the important questions for the future is which type of organiser and which type of venue will continue to do well in their markets. Surely organisers and venue owners that work together in a strong partnership, recognising the importance of the show brand, have a much better chance of delivering the level of value their audiences (visitors and exhibitors) are looking for, and are willing to pay a premium for.

About the author

Eyal Knoll joined JWC, a management consultancy firm in the trade fair and conference business, as a partner in 2012.

Over the years Knoll has lived and worked in Europe, North America and Asia, with organisations active in both both low-growth and emerging markets.

JWC has since grown to become one of the leading companies for major players (organizers, associations, venue owners and managers, service companies, private equity) active in the global trade fair and conference business. JWC created a name for itself supporting its clients by tackling pertinent questions facing the industry; international growth strategies; predictive analytics; pricing, venue master planning and quality, to name a few.