Globex co-editor Athan Siah says AMR’s 3-year forecasts are cautiously optimistic amid macroeconomic headwinds.

There’s no denying that it has been a tough three years for the global exhibition industry. While we continue to face an onslaught of challenges, it’s a relief to see that the tide is turning for organisers with many markets now on the road to recovery.

The move to a more positive outlook became clear as we at AMR International compiled our annual Globex report on the global exhibition industry. The team of strategy consultants set out three-year forecasts for 20* mature and emerging markets.

Growth to accelerate 2022-2024

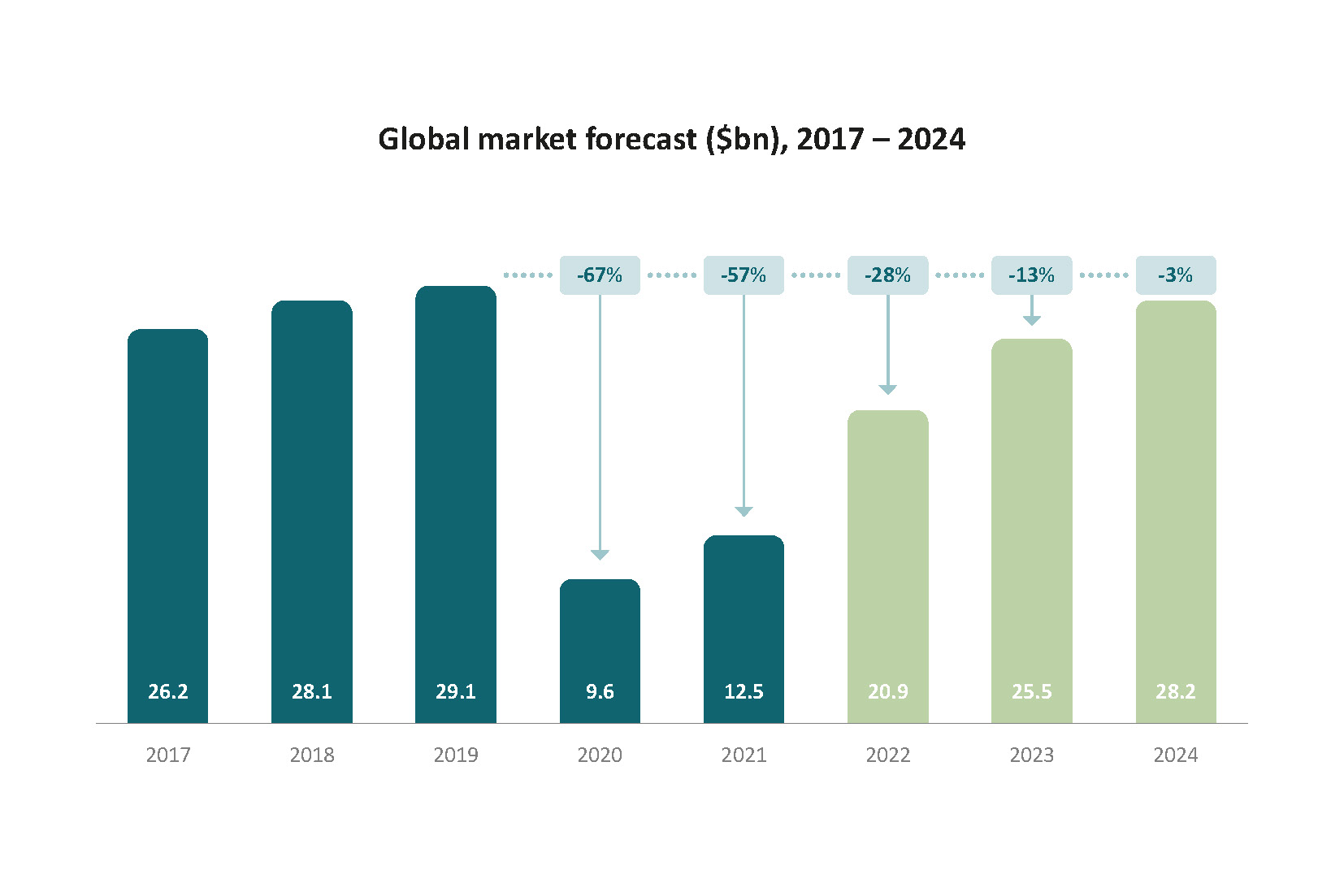

The good news, we expect recovery to accelerate in 2022, driven by the lifting of Covid-driven restrictions in the vast majority of countries (excluding China). From here, we forecast the global market to almost reach 2019 levels by 2024, albeit some of this being price-led as NSM volumes are likely to remain slightly below pre-pandemic levels in aggregate.

The chart below illustrates market performance over time, dating back to 2017 with market projections to 2024.

Moving on from Covid

As countries come out of the pandemic, there has been divergence in the recovery paths of their exhibition markets. Based on AMR’s 2024 forecasts, the US and UK, large mature markets where shows have largely domestic visitor bases, are expected to surpass pre-Covid levels and reach 105-110% of their pre-Covid high.

More cautiously, China is expected to reach c. 90% of its pre-Covid size by 2024, assuming (and this is a big if) there are no further large-scale Covid outbreaks that trigger regional lockdowns and prohibit exhibition activity. All other markets fall in the 90-110% range, with the exception of Russia, which lags far behind due to the ongoing war in Ukraine.

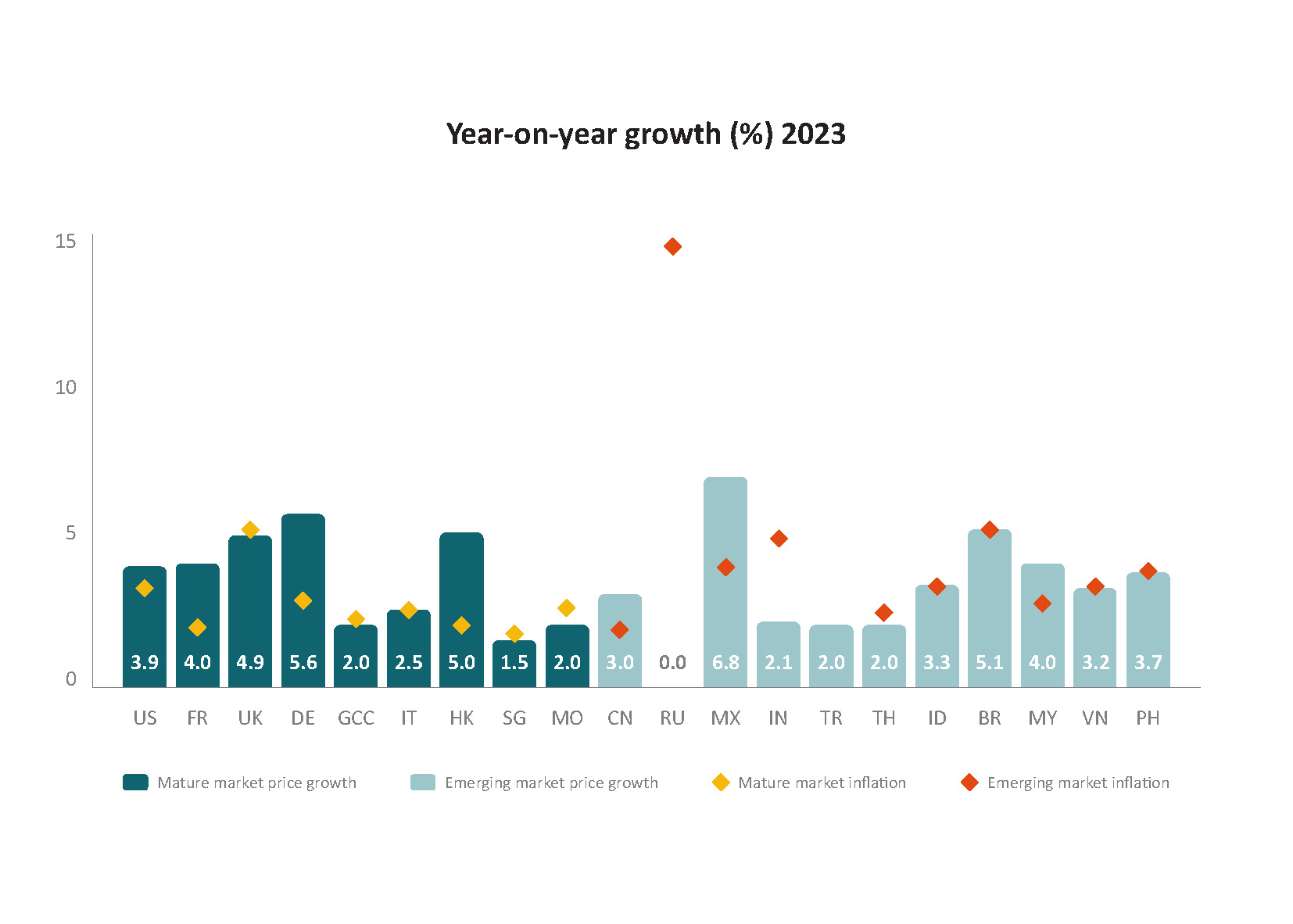

Growth in average price per sqm (2023) vs inflation

This chart on page 47 maps the estimated change in average price per sqm in 2021 across the 20 key exhibition markets, benchmarked against inflation. The markets have been ordered in descending order

of their 2021 size .

Expect a price-driven recovery

Post-2022, recovery of the exhibition industry will be price-driven in many markets. This is for two reasons. Firstly, rising inflation will affect the cost of holding exhibitions: venues, raw materials, personnel costs etc. Secondly, there was a trend of organisers offering discounts or additional space during the pandemic, which brought price per sqm below its long-term norms. We are already seeing some level of reversion to the norm. As a result, from our conversations with major organisers, it is clear that the path to recovery involves fully utilising their pricing power as the allure of face-to-face draws crowds back to exhibitions.

Macroeconomic factors will drive future growth

Looking further ahead, the business of forecasting how the exhibition industry will perform is also seeing a return to pre-Covid normalcy. Instead of looking at how governments deal with the pandemic, the largest factors driving growth are once again macroeconomic: the trajectory for the next few years will depend a lot on how the war in Ukraine progresses and its knock-on effects on supply chains and energy prices, whether double-digit inflation will spill over beyond Europe and the US to emerging markets worldwide; and whether warning signs of another global recession come true.

The future? Whatever happens stay ‘customer-centric’

Yes, there are lots of unknowns and challenges beyond our control. However, Globex found that the top exhibition organisers continue to take a forward-thinking approach. Bold moves are underway: their changing business models, embracing technology and truly becoming customer-centric organisations.

The concept of a ‘community catalyst’ where organisers engage with their customers all-year round is proving a real game-changer.

AMR’s Exhibitions 3.0 framework is also having an impact on strategic development. This framework is helping organisers secure longevity for their brands, using data, technology and insight to generate valuable customer connections across both physical and online channels. We expect this journey of transformation to create lasting value. No doubt we’ll see the impacts reflected in future Globex forecasts.

For more information about Globex 2022 visit: amrinternational.com/globex2022

* The 20 markets featured in Globex include: US, China, UK, Germany, France, Italy, Brazil, the Gulf Cooperation Council (GCC), Russia, Hong Kong, Turkey, Mexico, India, Indonesia, Singapore, Thailand, Malaysia, Vietnam, Macau and the Philippines.