JWC’s 2017 Global Industry Performance Review Top 40 Exhibition Companies: 2015/2016 reveals the industry’s robust growth.

Featured in the January edition of Exhibition World, JWC partner, Eyal Know (pictured), examines JWC’s insight of the near past, which, in turn, gives us optimism for the future.

Featured in the January edition of Exhibition World, JWC partner, Eyal Know (pictured), examines JWC’s insight of the near past, which, in turn, gives us optimism for the future.

JWC recently published its first review of the Top 40 Exhibition Companies, having collected data since its founding some 10 years ago.

Using a combination of figures pulled together from multiple (publicly available and verifiable) sources, a comprehensive view of the performance of the top players in the exhibition reveals a lot of movement and starkly different approaches to the business.

JWC’s Top 40 represent thousands of (small, medium, large and very large) exhibitions taking place every year. The revenue generated, from organising, hosting, servicing or managing the venues they are run in, is all in scope.

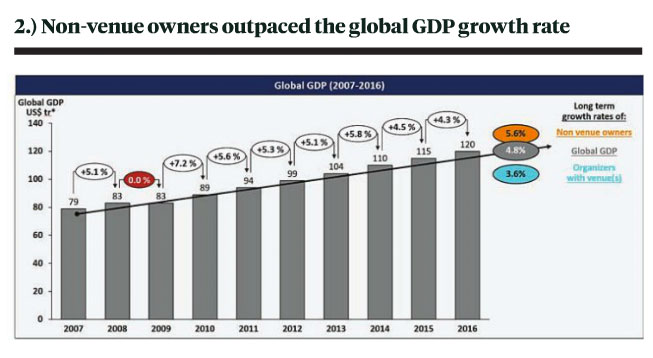

Taking them all together (Graph 1), the entire group has been growing at roughly the global GDP growth rates (Graph 2).

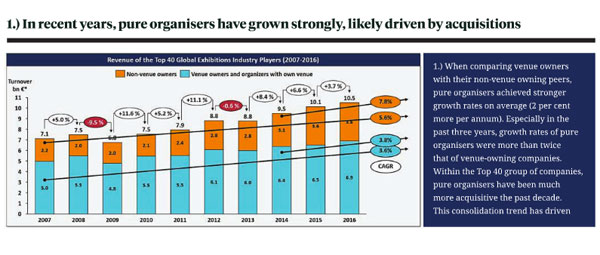

First interesting note: The group of companies, which also own or manage a venue, tended to generate growth just slightly below the global GDP growth rates; while ‘pure play’ organisers have been outpacing the global GDP growth rates by some margin.

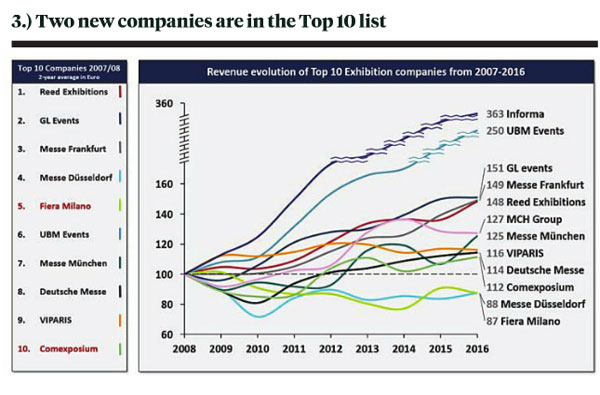

Turning our focus to the Top 10 (Graph 3), Informa’s remarkable journey becomes apparent. It wasn’t even in the Top 10 only a decade ago. By 2015/16 its exhibitions business unit had climbed to the No. 8 spot.

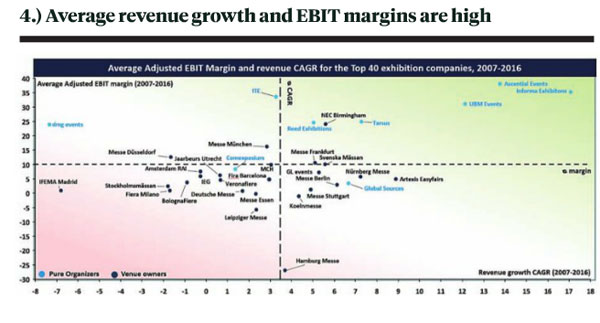

Fast forward to January 2018, it has just made an offer to acquire UBM, the No. 3. If successful, it could firmly place Informa at the top of the heap, ahead of Reed Exhibitions. Why could this happen? Graph 4 shows at a very high level that both firms have been following a similar approach to the business. Both UBM and Informa boast above average (acquisition-led) growth rates, but more importantly, they both ensured all along that the revenue streams they were generating or acquiring were well above (industry) average EBIT margins.

1.) When comparing venue owners with their non-venue owning peers, pure organisers achieved stronger growth rates on average (2 per cent more per annum). Especially in the past three years, growth rates of pure organisers were more than twice that of venue-owning companies. Within the Top 40 group of companies, pure organisers have been much more acquisitive the past decade. This consolidation trend has driven a significant part of their overall revenue growth.

1.) When comparing venue owners with their non-venue owning peers, pure organisers achieved stronger growth rates on average (2 per cent more per annum). Especially in the past three years, growth rates of pure organisers were more than twice that of venue-owning companies. Within the Top 40 group of companies, pure organisers have been much more acquisitive the past decade. This consolidation trend has driven a significant part of their overall revenue growth.

2.) In this comparison of revenue growth of the Top 40 exhibition companies with Global GDP for the years 2007 to 2016, Global GDP is measured in Purchase Power Parity (PPP) terms. Growth in our industry is tracking quite closely to the global economy, which is clear by looking at Graphs 1 & 2. The group of tracked companies (Top 40) averaged a 4.4 per cent annual growth; growth has slightly accelerated over the past 5 years.

3.) Regarding revenue ranking, there has been quite a lot of movement in the Top 10 list in recent years. Taking an indexed view (2007/2008 are base years), 2 UK-based companies stand out: UBM and Informa Exhibitions. Informa has more than tripled its revenue over the past ten years, while UBM has more than doubled. Both companies have relied heavily on M&A to grow their businesses. On average, the Top 10 companies grew by 5.6 per cent, per year. However, Messe Düsseldorf and Fiera Milano saw their revenue decrease during this period.

4.) Individual company performance is shown by plotting key dimensions for the past ten years: (i) revenue CAGR is measured along the horizontal axis and (ii) the ten-year average margin of Adjusted EBIT along the vertical axis. Nearly all pure organisers (non-venue owners), highlighted in blue, are in the top right quadrant, indicating healthy revenue and profit growth. Three German venue-owners yielded a negative average Adjusted EBIT margin: Hamburg Messe, Leipziger Messe and Koelnmesse, however, their revenue trend is positive.

Eight of the Top 40 companies experienced a decrease in revenue over the past ten years. All but dmg events are venue owners. Venue owners yielded lower margins and weaker growth. Factors contributing to this pattern include venue owners’ higher (venue-related) operating costs and that a number of them do not only focus on profitability but also on indirect returns.

JWC is an advisory services firm for the global trade fair and large conference sectors. Find out more about JWC, here.