- 80% of companies expect normal levels of operations from June 2023

- Revenues for 2023 are expected to reach 94% of 2019 level on average and, excluding China, up from 80% in 2022

- Internal management challenges and digitalisation become the two most pressing industry issues

- The complete report includes dedicated profiles for 21 markets and regions, showcasing different speeds of adaptation to the post-pandemic era

UFI, the global association of the exhibition industry, has released the latest, 30th edition of its flagship Global Exhibition Barometer research, which takes the pulse of the industry.

The results highlight the quickening pace of the industry’s recovery in 2022 and a positive outlook for 2023.

While there is strong evidence that Covid-19 is behind in most markets, where the full recovery is expected in 2023, there remain a few markets, including China, where this full recovery is not anticipated in 2023. Globally, the level of operations continues to improve, with a proportion of companies declaring a ‘normal activity’ gradually increasing from 30% in January 2022 to 72% in December 2022 and expected to reach 80% in June 2023 – aligning with pre-pandemic levels.

Companies from most markets expect to deliver 2022 results close to their 2019 levels. In terms of operating profit, around half of the companies are declaring an increase or stable level for 2022 compared to 2019 levels and increasing to 7 out of 10 for 2023. Those results for 2022 were achieved with no public financial support for 69% of companies, and for half of those that did, this aid represented less than 10% of their overall costs.

The most pressing business issues also reflect how the industry is now focusing on post-pandemic challenges and opportunities: ‘Internal management challenges’ (highlighted by 20% of respondents), ‘Impact of digitalisation’ (16%), and ‘State of the economy in the home market’ and ‘Global economic developments’ (both 15% of answers) are the most common ones. By comparison, the ‘Impact of the Covid-19 pandemic on the business’ is now marked by only 5% of companies as one of the most important issues (compared to 19% 12 months ago).

“We can stop focusing on ‘post-pandemic recovery’ – and move on! This 30th edition of our Barometer confirms that the recovery phase is ending in most markets around the world. While every market shows certain specifics, globally attention has shifted toward future challenges. Internal management – primarily staffing – and the need to further develop digitalisation are top of mind around the world,” says Kai Hattendorf, managing director and CEO at UFI.

Size and scope

This latest edition of UFI’s bi-annual industry survey was concluded in January 2023 and includes data from 367 companies in 56 countries and regions.

The study also includes outlooks and analysis for 21 focus countries and regions – Argentina, Australia, Brazil, Chile, China, Colombia, France, Germany, Greece, India, Italy, Malaysia, Mexico, Saudi Arabia, South Africa, Spain, Thailand, Turkey, the UAE, the UK and the USA – as well as five additional aggregated regional zones.

Operations

The highest levels of ‘normal activity’ for the first half of 2023 on average are expected in Brazil (98%), Turkey and the US (95%), the UK (90%), Italy and Thailand (88%), and Spain and UAE (85%). In China, only 29% expect a normal activity, and 40% a reduced one.

This overall very positive outlook is driven by the fact that exhibitions can now be held everywhere in the world, except in some places in China. In parallel, new hygiene measures are reported in several regions (in more than 20% of respondents in Malaysia, Saudi Arabia and Thailand). In China alone, as of December 2022, and combining all markets, 55% of respondents declared that exhibitions could be held (usually with hygiene measures), 17% reported that ‘only local events’ were and 28% said that events were still not allowed.

Exhibition organisers participating in this edition of the Barometer were also asked to evaluate the hosted buyers packages, whereby the organiser invites and hosts selected visitors in return for a guaranteed amount of business meetings with exhibiting companies.

Global results indicate that half of the respondents apply this concept, and while one in four of them are happy with the programmes, two-thirds declare having mixed results. Results vary significantly between specific markets, providing insights into opportunities for hosted buyer programmes.

Turnover, operating profits and public financial support

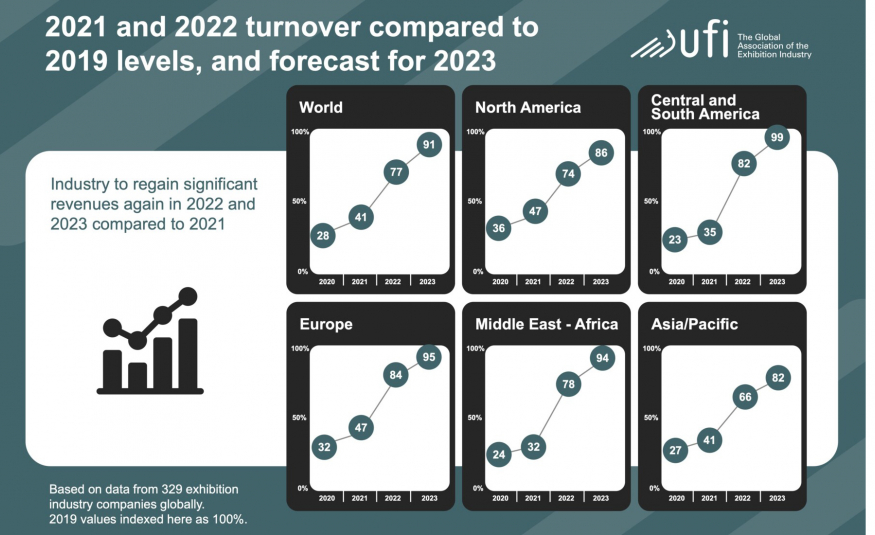

Globally, on average and excluding China, the revenues for 2022 and 2023 represent 80% and 94% of 2019 levels.

Colombia, France, Saudi Arabia, Spain, and Turkey have performed well above this average in 2022 and the UK will join that group in 2023.

In terms of operating profit, the markets in all the countries analysed are above average levels in either 2022 or 2023, or both, except China, Germany, Italy, Thailand, and the US.

Globally, 4% of respondents expect a loss for 2023, compared to 11% for 2022. The highest proportion of companies expecting a loss in 2023 is declared in China (18%), Germany (17%) and Italy (11%).

While the highest proportions of companies receiving public financial support are identified in Europe and Asia-Pacific, there are significant differences across all regional markets, and the percentages of companies declaring that they received ‘no public support’ varies:

- from 69% in the US to 100% in Mexico, for North America

- from 53% in Brazil to 83% in Chile, for Central and South America

- from 12% in Greece to 86% in the UK, for Europe

- from 67% in Saudi Arabia to 91% in the UAE, for the Middle East and Africa

- from 19% in Malaysia to 100% in India, for Asia-Pacific.

Key business issues

‘Internal management challenges’ is the key business issue for all regions, and it is the most selected issue for most markets. Within ‘nternal management challenges’, 67% of respondents selected ‘Human resources’ issues, 44% selected ‘Business model adjustments’, and 31% selected ‘Finance’.

For Germany, Italy, the UK and the US, however, ‘Global economic developments’ has become the most pressing issue.

An analysis by industry segment (organiser, venue only and service provider) shows no differences with regard to the three most pressing issues, which remain ‘Internal management challenges’, ‘Impact of digitalisation’ and ‘State of the economy in the home market’.

On the occasion of the 30th edition of the Barometer research, a special trend review has been undertaken to show how the industry’s priorities have changed in recent years. The analysis of the trend around top business issues over the 2015-2022 period identifies several important shifts:

- ‘Impact of digitalisation/Competition with other media’ now ranks as the main issue, with 30% of answers (compared with 14% in 2015).

- ‘Global economic developments/State of the economy in the home market’ have dropped from the main issue in 2015 (44% of answers) to 22% in 2021 and 29% in 2022, while the ‘Impact of Covid-19 pandemic on the business’ fell from 29% in 2020 to 5% in 2022.

- And ‘Internal management challenges’ has increased from 14% in 2015 to 20% in 2022.

In parallel, ‘Sustainability/climate and other stakeholders’ issues’ has doubled from 4% of answers in 2015 to 8% in 2022, while ‘Competition from within the exhibition industry’ has dropped considerably, from 20% in 2015 to less than 8% in 2022.

Future exhibition formats: physical and digital events

In addition to the 88% of companies who are confident that ‘Covid-19 confirms the value of face-to-face events’:

- 26% (compared to 44% and 63% previously) believe there will be ‘Less international ‘physical’ exhibitions and, overall, less participants’ (with 5% stating ‘Yes, for sure’, 22% stating ‘Most probably’ and 31% remaining unsure).

- 57% (compared to 73% and 80% previously) believe there is ‘A push towards hybrid events, more digital elements at events’ (with 10% stating ‘Yes, for sure’, 47% stating ‘Most probably’ and 25% remaining unsure).

- 5% (compared to 11% and 14% previously) agree that ‘Virtual events are replacing physical events’, while 11% are unsure and 84% state ‘Not sure at all’ or ‘Definitely not’.

Background

The 30th Global Barometer survey, concluded in January 2023, provides insights from 367 companies, across 56 countries and regions. It was conducted in collaboration with 21 UFI member associations.

In line with UFI’s objective to provide vital data and best practices to the entire exhibition industry, the full results can be downloaded at www.ufi.org/research

The next UFI Global Exhibition Barometer survey will be conducted in June 2023