Half-year financial results from global events company GL events report a 9% rise in revenues and a ‘significant’ improvement in profitability.

Total revenue for the period was up at €596m.

The interim financial statements for the 2019 first half were approved by GL events’ Board of Directors on 23 July 2019.

Olivier Ginon, Chairman-CEO of the Group (pictured above), stated: “In line with its goal of developing in Asia, GL events has finalised four acquisitions in China since the beginning of the year. Group revenue in the first half grew 9%, accompanied by a significant improvement in profitability.

“EBITDA grew 24% to €100m, current operating income 31% to €70m, and net income attributable to shareholders 35% to €35m. Based on these factors, combined with the positive outlook of the second half – notably with the Pan American Games and COP 25, I am able to confirm the achievement of the Group’s annual targets for revenue growth of more than 10% accompanied by an improvement in profitability. In addition, the Group is expected to achieve a leverage ratio of less than 2.9.”

The company said that changes in Group structure had accounted for 8% of the growth in revenue and that sales from international markets had accounted for 43% of total revenue compared to 49% at the end of the 2018 first half. The decrease largely reflected the concentration of mega events in H2 2019, the company reported.

Growth in results was largely put down to acquisitions and cost controls. The operating margin was 11.7% compared to 9.7% for the 2018 first half.

GL events Live, however, had revenues of €275.4m at 30 June 2019, down 3% in relation to 2018. (H1 2018 revenue included €50m from contracts for mega events. In 2019, mega events will be concentrated in the second half.) Excluding 2018 mega events, the division's revenue grew 18%, highlighting its ability to generate revenue from smaller-sized recurrent events: Maison et Objet, Dassault Convention, SIHH in Geneva, the Paris Agricultural Fair, the Paris Air Show, the Cannes Film Festival, Roland Garros, the Formula 1 Grand Prix of Le Castellet.

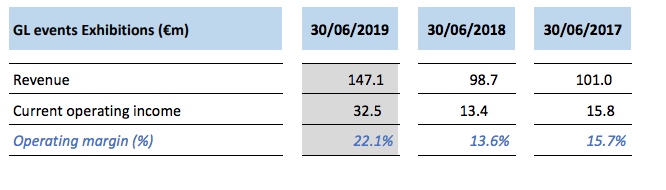

The operating margin was impacted by the shift of mega events to the second half and work designed to generate value at the Gerland site. Positive trends were registered by the major tradeshows organised by the Group (SIRHA, Global Industrie, Première Vision, Be Positive, CFIA), which GL events said highlighted the Group's ability to meet the needs of professionals in the corresponding sectors.

The CIEC Union exhibitions (Build+Decor in Beijing, the China International Door Expo and Beijing Fabric Wallpaper Expo) and the spring edition of Fashion Source contributed to H1 revenue and also the margin.

The improvement in the operating margin reflects positive impacts from the integration of the Chinese entities and also an improvement in profitability on a like-for-like exhibition basis.

Revenue from the Venues division grew 6.5% in relation to H1 2018. The Lyon destination benefits from a positive biennial effect and the other destinations also registered growth in revenue: Brazil, Paris, Barcelona and Budapest.

Events held during the period at the venue network included: Industry Days, Agro/Mashexpo and the World Table Tennis Championships in Budapest; Kingfomarket, SAP Hariba and Cinéeurope conventions in Barcelona; The Global Entrepreneurship Summit in the Hague, and The Automec, Batimat, Expo Mafe exhibitions at Sao Paulo Expo. The 2019 first half was marked by the integration of venues in France (Reims, Caen and Saint-Etienne) and in international markets (Johannesburg) as well as ongoing preparations for the operational launches of the Asian sites (Aichi & Canton). These factors, the Group said, explained the marginal decrease in the operating margin in relation to H1 2017.

Capital expenditures of the 2019 first half (€27m) were in line with budgetary priorities, the statement said, adding that, due to the favourable timetable of outflows for acquisitions in China (CIEC Union and Fashion Source paid in July 2019), the impact of external growth on net debt was limited to €17m.

The Group net source of funds was adversely impacted (€39m) by inflows recognised at the end of December 2018 linked to the concentration of major tradeshows in Q1 2019 by the Exhibitions division (Global Industrie, SIRHA, Be Positive…).

Net debt was stable in relation to 31 December 2018 at €378m. In light of the positive commercial outlook for the 2019 second half (COP 25, Pan American Games, opening of the Aichi International Exhibition Centre), GL events confirms its guidance for annual growth in revenue above 10% (based on exchange rates equivalent to H1 2019) and an improvement in profitability.