Between mid-2018 and the end of 2019, a majority of exhibition companies from all four global regions indicated Gross Turnover increases, according to the latest edition of UFI's Global Exhibition Industry Barometer.

UFI is the Global Association for the Exhibition Industry, and its research takes a regular pulse of the industry. The new data indicates the positive outlook is especially strong in both the Asia/Pacific and Middle East/Africa region, where new five-year highs are recorded.

In the Americas and Europe, however, fewer companies said they were expecting growth to be as strong as before.

Around the world, economic concerns, at national or global level, remain the top business issues for industry leaders, followed by competition from within the industry, internal challenges, and digitisation, the Barometer shows.

A large majority of companies are planning new activities either in the classic range of exhibition industry activities (venue/organiser/services), or outside of the current product portfolios, or in both areas. Also, a growing number of companies are looking to expand into new geographical markets.

The report also points out a good matching between the view of the exhibition industry and that of tradeshow visitors – expressed in the recent Global Visitor Insights produced by UFI and Explori – as to the need to develop the ‘entertainment’ component of exhibitions.

The new Barometer added one new partner to UFI’s semi-annual industry research: JEXA (Japan Exhibition Association), and the research presents a global overview of industry data, broken down into company types and 19 separate market profiles. This edition’s data is based on input from 302 participants from 53 countries and regions.

“The data shows that the exhibition industry is set to continue to grow globally as a whole, but foresees obstacles in various markets and regions. Ever more companies are focused on expanding their geographical footprint, to counter potential risks in the economic development in their respective home markets – most notably companies based in mature markets,” comments Kai Hattendorf (pictured), UFI Managing Director/CEO.

“Furthermore, there is no single formula on how to evolve exhibitions to respond to growing visitor demands of more entertainment or experience-driven events. The 19 detailed market profiles covered in this edition of the barometer show clearly differentiated approaches to this from around the world. These country and market profiles make the barometer so unique,” Hattendorf adds.

The UFI study delivers outlooks and analysis for 15 major markets - including Japan for the first time: Australia, Brazil, China, Germany, India, Indonesia, Japan, Italy, Macau, Mexico, Russia, South Africa, Thailand, the UK and the US.

In addition, the research adds aggregated data for four regional zones.

Economic developments

Regarding turnover year-on-year, 74% of companies around the world declared an increase for the second half of 2018, while 63% anticipate an increase for the first half of 2019, and 69% for the second half of 2019.

Several markets anticipate outperforming these scores for 2019: Brazil, China, Germany, India, Indonesia, Italy, Mexico, Thailand, the Middle East and the UK.

At the same time, a significant level of uncertainty exists in South Africa, coupled with several expected decreases in Australia, Japan and Macau.

In terms of operating profit, in each of the four regions, 80% of companies maintained a good level of performance in 2018 and around 30-40% of them declared an increase of more than 10% compared to 2017. The highest proportions of companies declaring such an increase are observed in Mexico (62%), Italy (56%), the UK (55%) and Indonesia (50%).

Top business issues

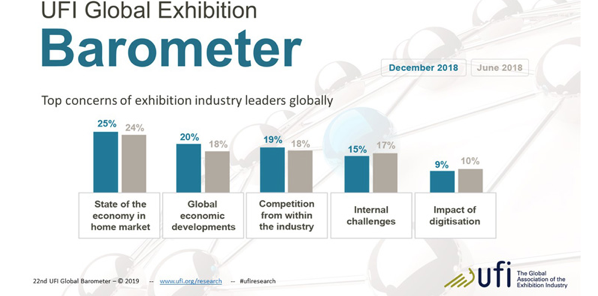

When asked about the most important issues for their business in the coming year, companies remain concerned about the following four topics:

- State of the economy in home market (25% in the current survey, up 1% compared to six months ago)

- Global economic developments (20%, up 2%)

- Competition from within the industry (19%, up 1%)

- Internal challenges (15%, down 2%).

‘Global economic developments’ appear as less of a concern in the Americas than in all other regions of the world, whereas ‘Competition from within the industry’ appears as more of a concern in Asia-Pacific, compared to other regions.

What makes an event more enjoyable?

The survey also tackled the ‘entertainment’ component of exhibitions with the most important items being:

- Talks and presentations delivered in different ways (40% in this survey)

- New technology such as Virtual Reality” (28% in this survey)

- Informal networking (37% in this survey).

The Barometer also points out regional priorities concerning the preferred ways to add entertainment elements to exhibitions. In the Americas and in Asia/Pacific, ‘Talks and presentations delivered in different ways’ receives the most backing. In Europe, ‘Interactive/Audience Generated Content’ receives the most backing. In the Middle East/Africa region, ‘New Technology such as Virtual Reality’ is seen as the most relevant element.

Strategic priorities

In terms of the range of activities, a large majority of companies intend to develop new activities, in either the classic range of exhibition industry activities (venue/organiser/services), other live events or virtual events, or in both: 72% in the Middle East & Africa, 78% in Asia/Pacific and 88% respectively in the Americas and Europe.

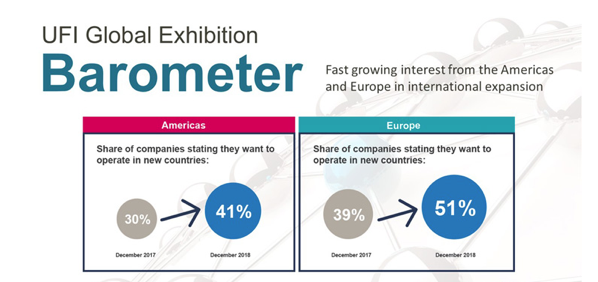

In terms of geographical expansion, four companies out of 10, on average, declare an intention to develop operations in new countries. At region level, Europe and the Americas show the biggest increase for this development when compared to the situation a year ago: 51% of companies based in Europe plan to operate in at least one additional country (+12% since last year) and 41% of companies based in the Americas (+11% since last year).

The 22nd Global Barometer Survey was conducted in December 2018 and was conducted in collaboration with 13 UFI Associations Members.

“In-depth research of this kind is the result of a trusted collaboration in the global UFI community,” says Christan Druart, UFI Research Manager. “This has allowed us to grow the number of market profiles.”

The full results can be downloaded at www.ufi.org/research.

The next UFI Global Barometer Survey will be conducted in June 2019.