Most airports in Africa’s top 10 are seeing a healthy growth in capacity, which is more international than it is domestic, although Nairobi is seeing a 22 per cent boost in domestic capacity.

ForwardKeys analysed 17m booking transactions a day, which it claimed illustrated double digit growth in flight arrivals for the first half of this year and little indication that the pace of growth will slow down soon.

The latest analysis of seat capacity for travel to the top 10 international airports in Africa, produced by travel data specialists ForwardKeys, reveals, however, that Lagos is seeing substantial declines in both domestic and international capacity, largely due to Arik Air cutting the number of seats available for the rest of 2017 by half.

Commenting on the data, Jon Howell, MD of AviaDev, Africa’s leading airline route development conference, said: “One of the major reasons for falling arrivals by air to Nigeria, is the fact that many airlines could not repatriate funds after the currency crisis in 2016. As a result, Iberia and United Airlines have ceased operations to Nigeria, while Emirates and the other foreign carriers have scaled back services.

“The Nigerian airlines have suffered too and so this void has been filled by the ever-opportunistic Ethiopian Airlines, which began serving their fifth Nigerian destination, Kaduna, on 1 August 2017 and is now the largest carrier in the Nigerian market.”

The wider report will make encouraging reading for airlines, governments and hoteliers planning to discuss possible new aviation routes at AviaDev conference in Kigali in October, organised by Bench Global Business Events.

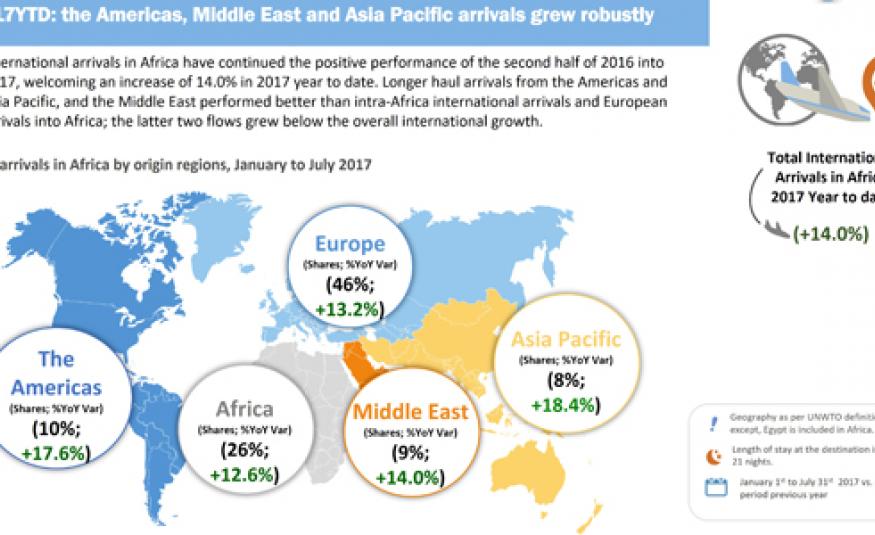

The report reveals that in the first seven months of the year, 1 Jan–31 July 2017, total international flight arrivals to Africa grew by 14 per cent over the same period in 2016.

Most significantly, growth was stronger for travel to and from the continent than within the continent. Arrivals from Europe, which make up 46 per cent of the market, were up 13.2 per cent. From the Americas, arrivals were up 17.6%; from the Middle East, they were up 14 per cent and from Asia Pacific, they were up 18.4 per cent.

By comparison, intra-African air travel, which makes up 26 per cent of the market, was up 12.6 per cent.

Looking at Africa’s top 10 destination countries, there have been stand-out performances from Tunisia and Egypt, both recovering well from terrorist attacks two years ago, up 33.5 per cent and 24.8 per cent respectively.

In addition, Morocco and Tunisia received a huge boost in arrivals from China, up 450 per cent and 250 per cent respectively, after they relaxed visa restrictions. The one disappointment is Nigeria, which has seen a 0.8 per cent drop, in the wake of recession in 2016, caused by a collapse in the oil price to a 13-year low.

Looking forward to the end of the calendar year, bookings for flights to Africa are currently 16.8per cent ahead of where they were on 31 July, 2016. Bookings from Europe are currently 17.5 per cent ahead, from the Americas 26.6 per cent ahead, from Asia Pacific 11.5 per cent ahead, from the Middle East 8.2per cent ahead and bookings for intra-African air travel are 11 per cent ahead.

Olivier Jager, CEO, ForwardKeys, said: “The growth in air travel to Africa is impressive. However, it is notable that consumer demand and airline investment is greater in travel to African countries from outside the continent than it is between African countries.”

Meanwhile, research organisation STR’s July 2017 Pipeline Report shows 56,925 rooms in 308 hotel projects under contract in Africa.

The total in Africa represents a 1.2 per cent increase compared with July 2016. Africa has reported 28,500 rooms in 163 projects under construction.