The recent UFI Congress in Johannesburg saw Jochen Witt deliver his 10th and last global economic overview in which he gave an interesting statistic – in the last five years more than 50 per cent of the exhibition acquisitions have been made by Private Equity owned businesses.

It is true to say that Emerald in the USA (still majority owned by Onex), Comexposium (Charterhouse) and Clarion (Blackstone) are currently at the top of the league when it comes to M&A activity.

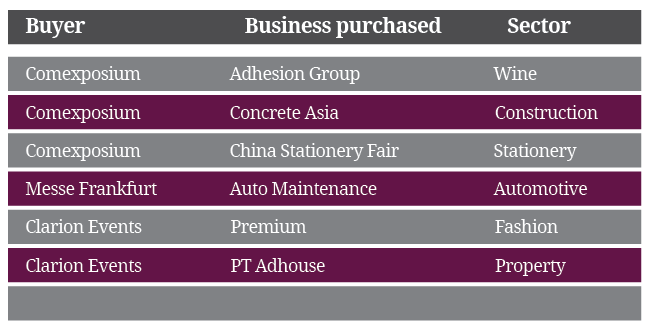

Recently, Comexposium acquired stakes in the Auto Show in Indonesia and Converse media in Denmark/Sweden. They have been keeping up the pace this month with the acquisition of Adhesion Group which has been owned by Euromoney for over 20 years. Adhesion runs a number of wine exhibitions including Vinisud, the leading Mediterranean wine show and also owns a 74 per cent stake in the World Bulk Wine Exhibition which takes place in Amsterdam. Comexposium increased their stake in World Bulk Wine to 90 per cent by simultaneously acquiring a further 16 per cent from Castillian company Pomona Keepers who originally launched the show. This represents another in a long line of recent non-core disposals from the major organisers, another trend we have been seeing throughout 2017.

Comexposium were also busy in Asia acquiring Concrete Asia and strengthening both their construction portfolio and their partnership with Bangkok hall manager and organiser Impact Exhibition Management. The show, which will be co-organised by the two companies will be co-located with Intermat Asean which was successfully launched in 2017. In China they announced the acquisition of the China Stationery Show. Comexposium has been in China for nearly 20 years primarily running their food exhibition Sial and China Stationery is their second joint venture in the country.

Clarion Events were equally busy, acquiring a majority stake in Premium, the Berlin based contemporary fashion trade exhibition. Its previous foray into fashion was in 2015, when they acquired the semi-annual Las Vegas trade show Woman’s Wear in Nevada (WWIN) through their US subsidiary Urban Expositions. It also made its first acquisition in Indonesia, buying a majority stake in PT Adhouse, organiser of Property Expo. This is the largest property exhibition in Indonesia founded 30 years ago and taking place over 10 days in August.

There is concern that the need for acquisition led growth by the PE owned organisers, in order to make sense of the investment, is pushing multiples higher and out of reach for others. Certainly activity by PE owned companies is stepping up and the size of deals required to move the needle is increasing.

The question is whether this is sustainable in the long term – are there enough businesses available to acquire to feed the machine?